This article may include partner links. If you click, visit or buy from these links, we will receive a fee or products from the companies mentioned in this post. Please read our disclosure policy for more details.

"Our most important thoughts are those which contradict our emotions" - Paul Valery

Hey everyone, thanks for visiting. It's been a few weeks since I've posted anything, just been going through a rough patch but I'm back now and ready to continue sharing our journey.

The past few weeks were busy, we had family over, I had a bunch of CPE units I needed to finish for my Real Estate license renewal as well as my Infosec Certs, on top of that I had to deal with an IRS audit of 2015 tax returns, I know huh, the luck of the draw i guess.

Really wanted to quit through all this BUT that'd be too easy. I've invested too much time and effort on this journey to not continue 🙂

I guess it was a blessing in disguise since I've been forced to ponder our lives thus far and the journey we had to this point as a family, more importantly as individuals, and can't help but be grateful for the bumps and bruises we've had that ultimately made us stronger.

In hindsight, if I had the luxury of a do-over, or be able to do a Marty McFly when he gets a chance to go back and confront his past, these are the "tips" I'd have written down to hand my 20-year-old self.

GET MARRIED AND STAY MARRIED

This is the first important piece of advice I'd share with my 20-year-old self. Not because I've been happily married now for more than 25 years but because I believe that sharing life with the person you love is the best and most profound way of using your life and energy.

Being married forces us to abandon our selfishness. If we want to get the most out of life, our lives, we have to share it. It's not always about us.

No better way to practice the Golden Rule which I paraphrased for purposes of marriage as "Love your spouse, treat them the way would want to be treated"; by doing so, we ensure that we can mature, grow and achieve satisfaction in life.

Plus, an added benefit is simply by doing life together, the chances of attaining long-term financial success increase significantly, according to the Census Bureau's Wealth and Asset Ownership Tables. Why, because by combining resources, planning, saving, and investing over a period of time as a couple naturally results in a better effort than if a single person would save and invest alone over the same period.

PRACTICE INTEGRITY

This is also a big one. One of the good definitions of Integrity I discovered is "It's what we do when no one is watching".

Why is it important? Because it builds character. Every time we do the right thing, especially when no one is looking, it builds up our inner self.

Of course, it's good to do things 'for show', it stokes up our ego, but it does little to improve our character, and character is the foundation of who we are, our beliefs, and the filter we use to base our decisions.

Taking it a step further, part of building integrity is when we say we'll do something, we should do it. I admit that I sometimes fail in this exercise but continue to strive and improve to keep and meet my commitments.

Always doing 'the right thing' will help us with our maturity and also ensure our success later on in life.

STAY AWAY FROM DEBT

This is a very important one. We won't be in the hole we're at right now if we had the common sense to see that debts, especially consumer debts are detrimental to financial success.

It will rob us of our time and life energy, read Your Money Or Your Life

Throughout our journey, we have initially thought that debt was a 'tool' that it was something we needed to 'get ahead'; but sadly, the opposite is true.

We were made to enjoy life and our time to spend in meaningful ways, instead of spending it earning money to pay off debts.

By staying away from debts, sticking to a budget early, living below our means, and saving for the future, it will all ensure our successful financial future rather than be spending 10 or however many years wasting life energy paying for debts we shouldn't have taken on in the first place.

ENJOY FAMILY TIME

TIME is a 'precious' commodity, in fact, when you think about it, it's more precious than anything you can monetarily put a tag on, since those things you can value. But IMHO we really can't put a value on time, even though the value people put on our time is the 'economic' value rather than life value; it's really subjective and depends on how we perceive our life's worth.

We believe that the most meaningful and enjoyable time we could ever spend as individuals are those that we get to spend with family and loved ones.

We were pre-programmed at a young age to pursue a life in light of it's 'economic' value, and most of us do, but we often see that even the most successful people end up losing it or end up with a 'meaningless' existence since the pursuit of happiness really wasn't meant to be focused on material things.

By making sure we take care of the 'important' things such as spending quality time with spouse, kids, relatives, friends, and community; we are assured of a balance, fulfilled, and well-lived life.

HAVE A PLAN AND SET GOALS

A map is important for navigating a destination. In the same way, as we navigate through life's peaks and valleys, we should come up with our own plans and goals map.

The saying that if you 'aim at nothing you hit it every time', well it's true. If we let life happen to us instead of 'happening' to life, we will get to the end of ours and look back at missed opportunities and regrets.

If I had a time machine, which I don't, I would've mapped out a goal for a career path early on as well as a financial plan to make sure I don't squander the earnings that would follow; be it as it may, even though I only got serious goal setting for my career in my 30s and a financial plan in my 40s, there's still time; the key is to give ourselves the opportunity to pivot, and change for the better, I believe there's no limit to what can happen after that.

So aim high and keep pushing farther.

AVOID STUFF-ITIS

It's just stuff... don't waste years of your life energy paying for stuff to 'impress people you don't know, with money you don't have', and even if you have money, life is not about 'he who gets the most toys', because he who does get the most toys, in the end, is still dead.

The most famous teacher who ever walked the earth once said, "Life does not consist in an abundance of possessions" and he was right, stuff won't make us happy, what will is to give it away.

Throw away any delusion that the latest and greatest will make us happy because it won't, we barely get our hands on whatever it is and it's obsolete; so don't get attached to ''stuff" because it is what it is, just "stuff".

WORK SHOULD NOT DEFINE YOU

Rick Warren put it plainly in his book the Purpose Driven Life.. 'We are Human Beings and NOT Human Doings' when asked about identity; and the point is, who we are should not be tied up with what we do for money.

What we do for work however important or menial, is just there for a season.

We don't expect to be working for money all our lives or being engaged in our careers forever, so don't get too attached to it also because what may end up happening is once we get to the end of our careers and we forget to separate our identity from it, we'll lose self-purpose.

Enjoy your career, make the most of every opportunity, learn as much as you can and develop your God-given talent, so that in the end, when it's time to hang up our gloves so to speak, we can in turn transition to mentoring others who need help or advice on how to navigate the waters we've just been on.

The goal is to not 'make it' just for the sake of making it, the goal is to, later on, pass it along 🙂

RELATIONSHIPS MATTER

Our personal relationships will dictate how we mature and develop as individuals.

If we surround ourselves with family and friends and strive to make a difference in our direct sphere of influence, it eventually helps us grow our character and help us have a sense of love, empathy, compassion, and awareness for the needs of others.

Practice being 'present'. Be there for your family, for those who depend on you.

On your deathbed, you hopefully won't be asking for the expensive gadget, jewelry, car, or 'stuff' that you've collected, that'd be too sorry.

If you have a healthy relational well being you can be assured that when the moments count, you'll have the support and love you'll need to sustain and see you through.

DON’T SWEAT THE SMALL STUFF

Ever heard the saying "making mountains out of molehills"? It's essentially the tendency to focus and magnify the 'minor' stuff instead of focusing on what matters.

Life will get hectic, it will be messy and ugly at times; the key to not getting 'bent out of shape' when things happen is to practice situational awareness; meaning to give yourself time to digest the current situation in light of the bigger picture.

For example, when tempted to get angry about someone cutting you off in traffic, count to three and think to yourself what it would take to let the negative emotions slip through. Think of what would happen to you and your family if you get into an accident trying to 'get back' at whoever, or worse even jailed all because our emotions got the better of us. Those are small compared to the peace of mind that comes with not getting in trouble.

I've recently learned that "letting go" of little things will do wonders and us help tackle the bigger things later on in life.

BE RESILIENT

Arnold Schwarzenegger once said part of his 5 life rules is ‘ignore the naysayers’, in short, don’t live for the approval of others, there will always be haters, learn to turn their negativity into fuel to drive you forward.

Life is hard, it will get harder if we don't learn to take our lumps and tough it out, get back up and get back into whatever race, journey, competition, etc.

Being resilient is not about ignoring the fact that there will be disappointments and failures; it's about how we react to them, are we going to hit and punch back, or are we going to cower in fear and shrink?

Be strong, learn to bounce back, don't wallow or settle for mediocrity. We were born to be winners believe it or not, on the inside of us, are all the recipes we need for success, it's just waiting to be harnessed, brought out, practiced and wielded.

Learn to 'TERMINATE' the doubt and doubters; move and keep moving forward and upward.

KEEP LEARNING

Be a lifetime learner, popular mythology allege that we only use 10% of our brain at any given time, this was debunked by science and explained by Dr. Bruce Lipton.

Our brains are the most important part of our bodies since it is the command and control of everything that happens. It turns out that as we mature and grow older, because of 'brain plasticity' our brain and capacity for thinking and learning improve or conversely deteriorate depending on how we feed or exercise it.

By having a mindset of continuous learning and development, we not only help our brain function increase to enhance our thinking and overall health, we also contribute to our overall longevity.

It's a win-win situation really. Feed the brain and be smart, get promoted in your chosen career, be financially successful in the process, and live longer. Who doesn't want that?

So keep reading, learning, exercising, and overall healthy; you'll thank yourself later on for it.

TURN FAILURES INTO LESSONS

We're all going to fail, it will come, just as surely as night turns into day, we will face failures on our journey. But the key to having a successful and fulfilled life is to learn to handle failures.

John Maxell in his best selling book "Failing Forward" put it so elegantly - "The difference between average people and successful people is their perception of and response to failure"

Learn to "perceive" failure not as a setback but as an opportunity.

The most successful people walking the face of the earth today and even the one's previous attribute their success to one failure or another. The most notable of which was Thomas Edison, imagine having failed more than 1,000 times as he was developing the light bulb; if he'd had quit, the world would never have experienced the industrial revolution and technology as we now know it.

How we "respond" to failure is also as important as how we perceive it, by having a resilient mindset, practicing 'grit' and determination in spite of and despite the perceived odds; we ensure that our character is built up over time and we develop confidence and tenacity to beat whatever odds face us the next time around; so keep pushing, keep fighting, and learn to be an overcomer.

Here's to difficulties and failures, because if you didn't come across them, you might have ended up worse off.

DO A BUDGET AND INVEST

This one's a major one. It would literally mean having 'Financial Peace' or being broke for the better part of our working lives.

If I'd had known this principle when I was younger, I wouldn't have wasted my energy in 25 life years trying to catch up; BUT, like I previously mentioned, setbacks are opportunities also, so I embrace this opportunity to have learned this now rather than much later on down the road.

So, big item #1 is 'DO A BUDGET'. It's just simply writing down how much you earn versus how much you spend in a given month, that's it nothing fancy.

By doing so you figure out where your money goes, rather than wondering where it went. This lines up beautifully with investing, since if you know the amount of money coming in versus the amount you need to spend on expenses, you can basically adjust accordingly to be able to free up enough money to start investing, and early.

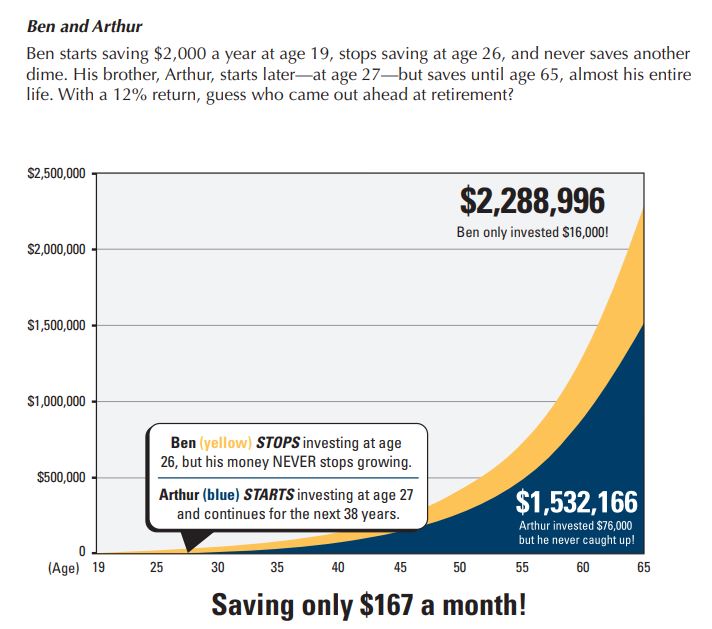

Why is it wise to invest early, because of the 'compounding' effect of interest; and an oversimplification of this principle is found in Dave Ramsey's 'Ben and Arthur' illustration where 2 brothers contrasted their savings over time; the principle, of course, is as money is given enough time to sit and allowed to grow, along with its interest being reinvested, having a snowball effect, over time it turns into A LOT OF MONEY.

So by doing a budget, living within your means, and investing early, you're assured of a solid financial future; what you do with the money later is entirely up to you 🙂

BE GENEROUS

We've already settled earlier that 'stuff' shouldn't be a priority, that if we spend the better part of our lives chasing after it, we'll wind up empty and deceived since life isn't about the pursuit of stuff.

So what is it? What's life all about then? If all we're programmed to do is to work, earn, save for later; then what's the point?

Well, to put it plainly, the most meaningful part of "having enough" is so we can give some or most of it away. That's the secret.

Until we settle in our minds that by giving we in fact gain, we won't be truly happy or live fulfilled lives. Because in the end, there's only so much stuff that can be collected or choice food to be had, these are all good, but materially irrelevant. What we ultimately yearn for as human beings is "significance". To have meaning. And the paradox is, by giving of ourselves, we, in turn, find them.

So as we build our careers, our fortunes, and hit our goals in life; don't forget to give, time, energy, money, to those that are in need; be generous because that is what will make us enjoy what we've built.

CONSIDER YOUR LEGACY

"Consider".... what a powerful word. Merriam and Webster has it down as "to think about carefully".

So in light of what we've enumerated above, it all boils down to What's the point? What's the big deal? Why are we doing what we're doing? What's the end game?

Well, in very simple terms, it's our legacy or to simplify, it's what we leave behind. Do we leave behind a world that's better off than when we first came in? will our families be better off when we leave them? or will we be stuck in just the taking or using of our lives and resources?

We've already learned that a major part of being successful and fulfilled is by being generous, so the end game for us should be that as we journey and aspire to a life well lived, we make sure that we leave the same for our family first, and then to the causes that give us joy and happiness in life.

Being financially successful ultimately boils down to can we keep it so that we can entrust it to the next generation.

A good man will leave an inheritance for his children's children, says Prov 13:22 so to me, that's the end goal.

IN CONCLUSION

In light of all these tips, if only I can go back and hand this over to my 20-year-old self; I'd definitely be living a much better life right now. But as we've already gone through beforehand, the opportunity is NOW.

NOW is the best time to 'CONSIDER', are we going to live life status quo, or are we going to be OVERCOMERS and grab life by the horns and BECOME our potential? I suggest to you to do just that 🙂

Do you have other tips that can help our 20-year-old selves? Please do share by leaving a comment or emailing us at thedebtfreejourney@gmail.com.

As always, thanks for spending time and until our next post...

Peace and Blessings to you All.

Leave a Reply