This article may include partner links. If you click, visit or buy from these links, we will receive a fee or products from the companies mentioned in this post. Please read our disclosure policy for more details.

“You can’t be in debt and win. It doesn’t work.” Dave Ramsey

We’re 3 months into our Debt Free Journey and here are our snapshots

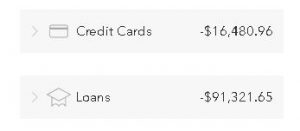

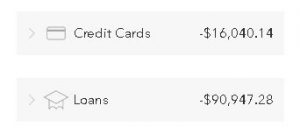

Our previous month’s total debts were at $120,452, this month it’s down to $118,731, a decrease of $1,721.

That doesn’t seem like a lot especially with our debt payment budget of $2,041, but it’s getting there. We can definitely see the power of compounding interest working against us in this situation.

Boy o boy, what an uphill climb. Nevertheless, we know it’ill be a struggle and are already imagining what it would be like to get there, to be Debt Freeeeee 🙂 so we’re keeping at it.

Slow and steady wins the race as they say.

OUR NUMBERS

April 2017

May 2017

We kinda broke Dave’s rule of not using the card last month 🙂 don’t tell him.. we bought a vlogging camera off eBay, the Canon G7X, what would normally cost like $659 we got used for $430 and since eBay through PayPal was offering a 6 month no interest deal, so we dove in and bit the bullet, I just have to list more stuff on eBay and get stuff sold to cover this additional $430 expense.

Oh well, it’s an investment that hopefully will pay off later.

What else did we mess up on? Well, nothing else I guess. We didn’t mess up our budget, even though i hadIone day of not getting paid due to the Memorial day holiday, but overall, we covered our budget this month.

LAST MONTH’S GOAL UPDATES

OVERTIME

Didn’t quite work out, I was only able to work 1 hour OT, I initially planned on working 5 hours but I spent so much time figuring out my website and read up on my personal development books. So between those, spending time with friends and family, and volunteering every other Sunday at Children’s ministry, I decided to skip the OT work altogether.

TAX DEDUCTIONS

Okay, so I re-submitted my updated W4 and was only able to free up $240/month from my tax withholdings, not much but will go a long way with my debt snowball.

SELLING THE CAR

This one is way trickier since we owe more than the car’s now worth, naturally, but it’s still on Craigslist.

My wife, however, is deciding to keep it and pay it off, since our now teenager will, later on, inherit this car down the road.

It’s a great car, but currently, hurts paying it off at the moment. We’ll manage it nontheless. We shall see 🙂

MONETIZING

Well, this one I don’t know… After reading up on a lot of bloggers out there, about monetizing strategies, I decided to go the Affiliate route, so just a heads up, if you see URL links, and I do disclose them at the beginning of my posts, they’re there to kinda support my site which I now spend money on monthly to get it to where it should be.

I didn’t want to flat out sell stuff since I’m not good at it and furthermore, didn’t want to turn readers away by offering paid ads. I should know, i’m like that. When I visit other sites and see too many ads, I close out and move on the next, but that’s just me.

GOALS FOR THIS MONTH

OFFER FREEBIES

I’m working on a free ebook about the Ultimate Guide to Buying Real Estate and hopefully should get that up within 2 weeks, barring any unforeseen difficulties.

I also want to offer the budget tools I use, that would hopefully help others like myself, so stay tuned.

KEEP TRACKING MY SPENDING

Did I mention that Personal Capital is the bomb!!!! I prefer using it now from mint, It just feels more secure, report views look really better, and best of all, it’s FREE.

Who wouldn’t want that? Make sure to check them out for more details.

TRY TO WORK O.T. (Again)

Will try another stab at it, will try to make 5-hour goal again, hope I can do it, especially since I’m going on vacation with the family end of the month; don’t tell Dave 🙂

WRAPPING UP

Although it feels overwhelming at times and a bit frustrating, we are definitely going for it. Just imagining the feeling of finally breaking free of debt, and of course visiting Nashville and doing a ‘debt free scream’ with the teacher himself, Dave Ramsey, is all the motivation we need to keep plowing through.

So DEBT, you’re going DOWN !!!!!!

Do you have a similar debt situation that you’re trying to overcome? Any strategies you want to share?

Please send us feedback below and if you like to join our journey, won’t you SUBSCRIBE via the form below.

Thanks for stopping by, and until next post.

Peace and Blessing to you All.

Leave a Reply