This article may include partner links. If you click, visit or buy from these links, we will receive a fee or products from the companies mentioned in this post. Please read our disclosure policy for more details.

"It always seems impossible, until it's done."

Hey everyone, so months 15 and 16 flew by, there wasn't much action 🙁 I didn't do much of anything and took a break 🙂

I guess the journey got too daunting for me that I took a 2-month sabbatical.

Financially there was little progress, we didn't pay extra one since we took a mini vacation and cash flowed that one, and I also paid for a certification test that I'm scheduled to take in September and it cost me a whopping $900.

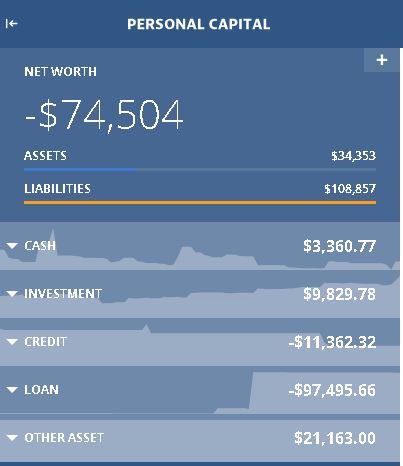

Here's what the 2 months looked like...

It's not too good, but i figure it ain't too bad either. $941 debt reduction is still that, reduced debt.

Any kind of forward momentum is a step in the right direction, so i just have to pick myself up and re-motivate and plow through.

PERSONAL DEVELOPMENT

Like i mentioned earlier, i'm going through another round of security certifications and i'm forced to read through the voluminous text in the CISM All in One Study Guide .

It's quite an ordeal considering it's a very dry read but oh well, gotta do it since passing this cert is one of my goals for the year.

To break the monotony of the CISM subject, i picked up Dave Ramsey and Rachel Cruze's "Smart Money Smart Kids" to get an insight on how i should educate my teenager on mone during and after our debt free journey. It's a very fun read and i highly recommend it to parents of kids of any age 🙂

UPCOMING GOALS

- Pass my CISM test - that's scheduled for September 4th, I should have a blog post out for that one once it's done.

- Reduce our debt by at least $1500 for July-August at a minimum.

- Work on my Real Estate side hustles, I'm currently working on a listing and hopefully a sale which should net me a good amount, enough to eliminate my car and credit card; more on that later.

- Not give up and continue posting quality content.

WRAPPING UP

My favorite financial guru once said, "It's very easy to wander into debt, but really hard to wander out". The moment I heard that I was like, 'you can say that again'.

It is really hard, very frustrating as well as deflating at times. But nonetheless the 'WHY' is what keeps me, us, going.

- What if we didn't have any debts and are able to redirect $2500/month or more to wealth building?

- What if we can cash flow our daughter's college so she wouldn't have to deal with the same issues millions of kids do?

- What if we don't have to work for money and can wake up without any financial cares and burdens?

- What if we can give money whenever we see a need around us?

- What if????? it goes on and on... And that is what keeps us going, it's what's supposed to motivate us to move forward!

Do you have tips or tricks you'd want to share to accelerate our debt free journey?

Please do comment below or email us at thedebtfreejourney(at)gmail.com

Til our next post...

Peace and Blessings to you All.

Leave a Reply