This article may include partner links. If you click, visit or buy from these links, we will receive a fee or products from the companies mentioned in this post. Please read our disclosure policy for more details.

THERE IS TROUBLE AHEAD

According to recent data released by the Federal Reserve Board , delinquency rates for credit card debts in the fourth quarter 2016 rose to 2.34% and is slightly higher than what they were in the same period for 2015 which is 2.16%.

In a similar report posted by moneytips.com taken from recent American Bankers Association (ABA) data state that;

“credit card delinquencies increased to 2.74% of all accounts and that auto loan delinquencies increased to 0.87% of all”

“Figures show that six million Americans are behind on their auto loan payments by at least 90 days.

This delinquency is causing concerns for lenders.

WHAT THE BANK SAYS

Researchers from the Federal Reserve Bank say that late payment levels are now at their highest since 2010, and pressure may increase for borrowers to prove their financial circumstances. The car loan market is robust but recent years have seen an increasing level of delinquency in subprime loans.

As a result, there is a mounting worry, because similar trends in behavior occurred in the lead-up to the financial crisis in 2008.”

SO WHAT’S THE DEAL?

The data suggests that common households who barely got out of the last recession are yet again subject to another credit crisis, this time fueled not by housing or ‘secured’ loans but by riskier ‘unsecured’ consumer debt. Subprime loans which were demonized almost a decade ago is now back and thriving yet again in the broader consumer lending landscape.

The Kansas City Feds released a poignant report entitled “Tracking Consumer Credit Trends” in Aug 2016 and an excerpt reads

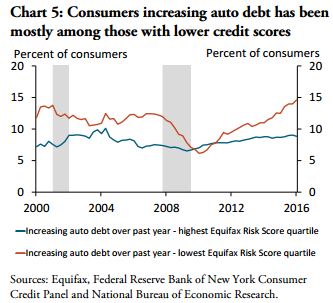

“Consumers with lower credit scores have primarily driven the increase in auto debt borrowing. Chart 5 compares consumers with credit scores in the highest and lowest quartiles and shows the rise in auto loans has been more pronounced among those with lower credit scores.

Since 2010:Q1, the share of consumers with lower credit scores increasing their auto debt has grown from 6 percent to almost 15 percent. In contrast, the share of those with higher credit scores shows only a modest upward trend, with even a modest tick down more recently”.

IS HISTORY REPEATING ITSELF?

This is a glaring indication that predatory lending is once again a factor in people’s consumption habits that eventually lead to compounded debt issues.

The broader economy might be showing continued signs of recovery from the recent great recession but these troubling indicators prove that if the current trend of borrowing and delinquency continues, another economic event similar to the recent recession a decade ago might be brewing in the works.

CONCLUSION

My final note, stick to the plan. We don’t care what the broader economy might say since we’re in the hole anyway. Just keep at it, so that one day we can get ‘debt free’ 🙂

Do you have anything you want to add or comments you want to share? Please leave them below or email at thedebtfreejourney@gmail.com.

Peace and Blessings to you All.

Leave a Reply