This article may include partner links. If you click, visit or buy from these links, we will receive a fee or products from the companies mentioned in this post. Please read our disclosure policy for more details.

Here’s the 2nd month snapshot of our Debt Free Journey.

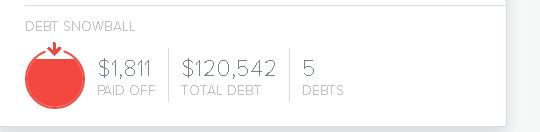

We initially had a total of $122,306 of combined debts since March 23; we are now down to $120,452 a net reduction of $1,854 (personal loan numbers aren’t shown in mint snapshot since it’s from the bank of Mom).

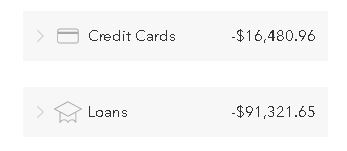

Mar 2017

Apr 2017

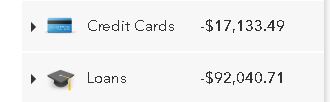

Here’s a snapshot of where we started, February 2017’s debt numbers.

These are our Apr 2017 debt numbers.

It’s the second month of a calculated 70-month ordeal.

We decided to take it easy in our first year with debt repayment although the more I think about prolonging the agony, the more I get anxious.

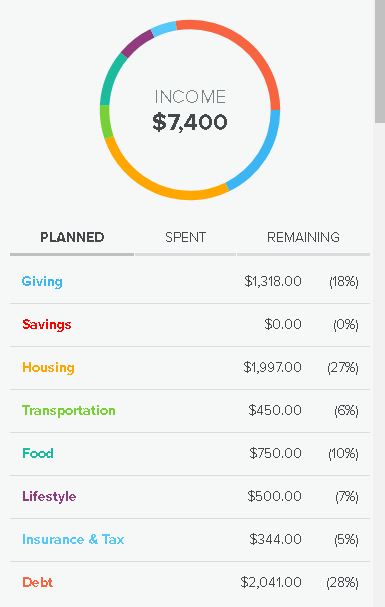

We’ve raised our current monthly budget to $7,400 so we can designate $2,041 to our repayment plan.

One thing I did do this month is to sign up with Personal Capital, which I now prefer over Mint since I can add and view offline loans such as the personal loan from my Mom.

I also rolled over about $6K worth of 401K money from my previous employer to Wealthfront, instead of cashing it out and netting half and apply to my loans, I decided to keep it and not deal with the penalty and also use it as an experiment to see if robo-investing works and how it does overtime.

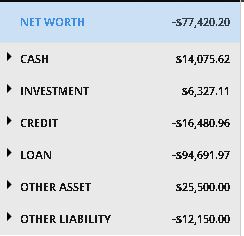

So starting this month, I’m now able to track our net worth. As you can see, we still have a long ways to go but slow and steady, we should get there.

Plans for this month

Work some OT. Since I’m an hourly employee, I plan on working at least 5 hours overtime to see how much I can make and apply toward my debts. One negative thing I hate about working OT is that more than half of it usually goes to taxes, so I’m always hesitant. But we shall see.

Re-evaluate my tax deductions. Upon examining my paycheck, I believe I’m having too much deducted for taxes on my paycheck, I know since I got a good tax refund, it’s good and it’s bad. Good is I get money back at the end of the year, bad since I’m overpaying taxes and letting the government use my money interest-free.

Sell the car. This one would hurt a little bit since it’s my wife’s present for her birthday last year. But now that we’re on this journey, she realized that it’s not turning out to be a good gift and is now willing to sacrifice towards her financial security which is a much better gift overall. So if you know someone in the LA area that needs a car, let me know 🙂

Finally, work toward monetizing my blog. I’ve gotten a lot of great tips from other bloggers; namely nataliebacon.com, wellkeptwallet.com, thepracticalsaver.com, to name a few. I’ll see if I can finally apply the practical steps they teach towards my blog. Stay tuned, the look and feel of this blog should change, albeit for the better.

Do you have any other suggestions? Please let me know if you have any question, comments or feedback by sending a note below or emailing at thedebtfreejourney@gmail.com

Peace and Blessing to you all.

Leave a Reply